What Does Trauma Have To Do with Financial Health?

How a relational and biblical approach to financial education transforms more than just budgets.

When John was in the military nearly four decades ago, he experienced profound abuse and discrimination. Like many who experience this type of trauma, John began numbing his pain through substance abuse. Homelessness followed. Eventually, he began living in a “trap house”— a place where dealers provided an endless supply of drugs.

There was no dignity in John’s life in the trap house, where he lived for 20 years. It deepened his sense, which he had first learned from the abuse and discrimination, that he was worthless.

An Unlikely Source of Dignity

Now nearly 60, John has finally reclaimed the dignity he felt he had lost, and he discovered it through an unlikely source: a financial literacy course he took as part of his recovery at Lighthouse Ministries in Lakeland, Florida.

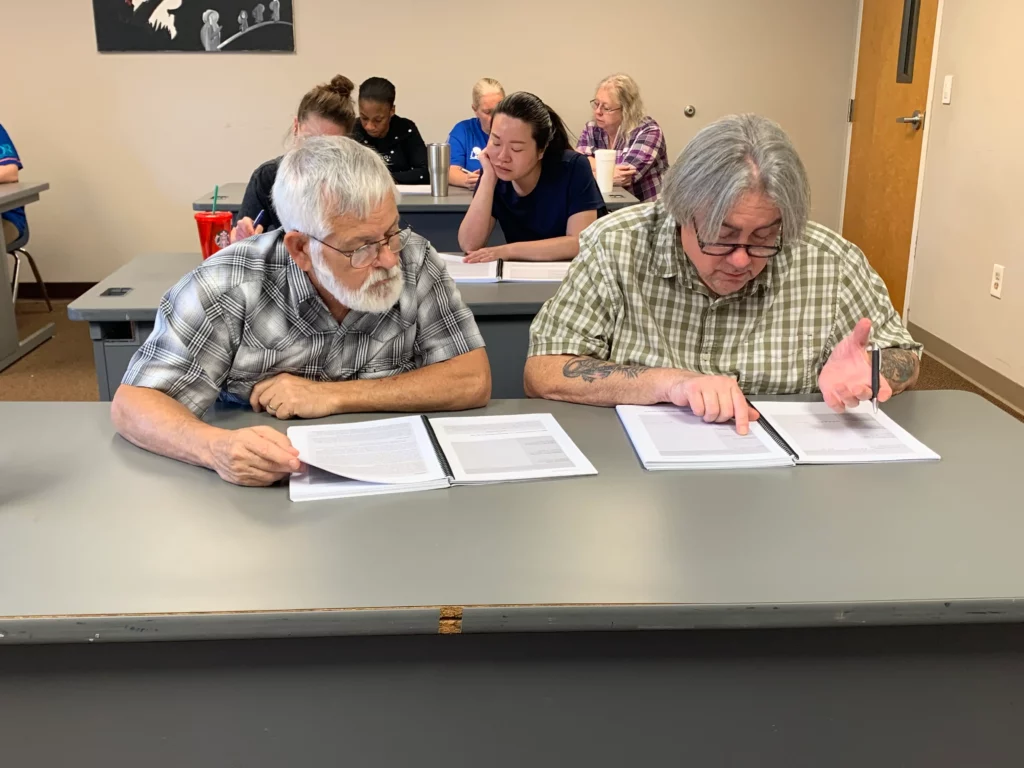

Scott Turbeville, Director of Adult Education at the life learning campus, realized that the men and women in his program needed a different approach to financial education than the curriculum they had been using.

“The focus [of that curriculum] was on building wealth, and God probably isn’t calling any of us working at or living at the shelter to be extremely wealthy people,” Scott chuckles.

Scott also wanted a curriculum in which biblical principles were integral to the message. The community Lighthouse serves come from backgrounds of severe trauma, homelessness, and often substance abuse. They need the truth of the gospel to lead them to long-term change. But often, Scott found that Christian curricula felt forced, as if the biblical principles were artificially inserted after the fact to check the box of being “biblical.”

A Curriculum Teaching Biblical Stewardship Principles

That’s when Scott discovered Faith & Finances, a financial education curriculum from The Chalmers Center that empowers people in material poverty with not only money management skills but also biblical stewardship principles and supportive relationships. He began using Faith & Finances at Lighthouse, and it became one of the tools in the ministry’s workbox to empower life change in the people they serve.

Through the course, John learned not just how to budget and use his finances wisely, but he discovered that God had created him with dignity and worth. He learned to navigate a broken world and that community and healthy relationships are key to a healthy financial life. Now John has a steady job at a university in the custodial department and is about to start college.

“What John is able to achieve is beautiful,” reflects Scott.

Faith & Finances has also helped Scott and his team in their relationships with people in Lighthouse’s program. It has been a key tool in beginning conversations, as it opens clients’ eyes to how important community is to staying sober and staying on the path they’ve chosen for their lives. The curriculum helps individuals assess what assets they already possess that they can use as they are developing their new lives. This has been an epiphany for many of those who take the class.

“When we do the assets lesson, about 100% of students affirm that human assets are the most important. They understand that relationships are the most important element to having healthy finances. That’s a pretty huge eye-opener for them,” Scott says.

This realization provides Scott and his team with direction for case management. They ask clients what God still needs to heal in their relationships with Him, with themselves, with their families, and with the world.

Stories of Change

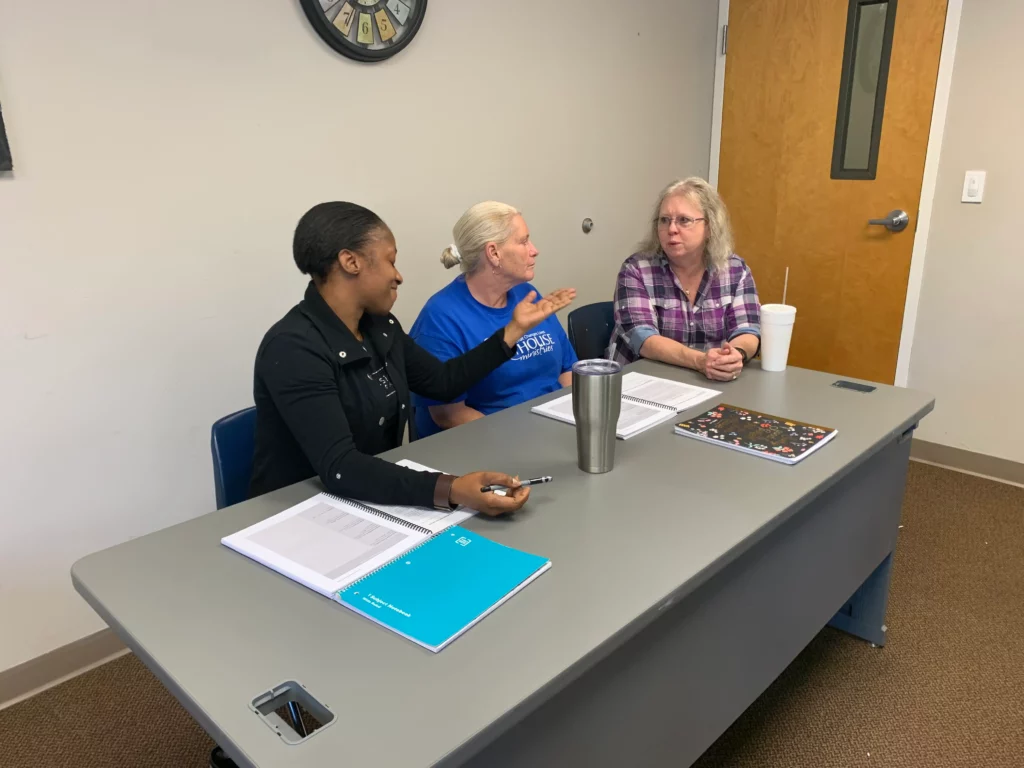

Another woman who experienced God’s transformative power, thanks in part to Faith & Finances, is Kellie. A mother of four, Kellie realized through the program that she had a spending problem, in particular with overspending on one of her children. When she examined the issue from the relational, holistic approach the program takes, Kellie broke down crying.

“He’s the only child I used drugs with while I was pregnant,” she confessed.

Kellie realized that she needed to accept forgiveness for her past, rather than trying to earn her son’s love through money. Kellie appreciated what she learned through Faith & Finances so much that she had her mother enroll in the class. Though they came from generations of poverty, Kellie and her mother have now broken the cycle and own a home together. Kellie has also become a staff member at Lighthouse Ministries and is moving into case management — helping others on their path toward wholeness.

A Holistic, Relational Ministry

For Scott, one of the things he appreciates most about using Faith & Finances is that it keeps him and all the other staff and volunteers at Lighthouse on-mission: focused on the gospel even when teaching financial management. It helps residents discern what next steps God is calling them to pursue.

It’s not easy — Scott emphasizes that it requires a team to take this kind of relational, holistic approach. But it’s one of the tools God is using to help them meet their mission — of communicating the Gospel of Jesus Christ to meet the physical and emotional needs of people living in poverty.

Interested in bringing Faith & Finances to your church or ministry? Click here to learn more and register for the next facilitator training.